Funding for Solar Panels: Complete Guide

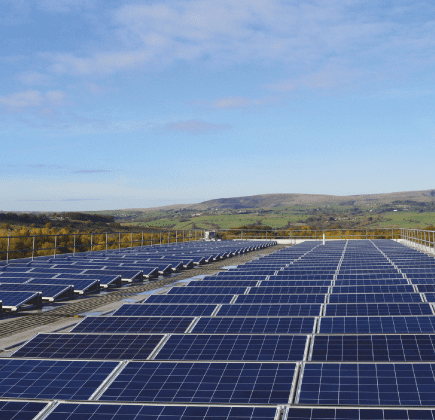

With energy prices remaining unpredictable and carbon-reduction targets tightening, more UK businesses are turning to solar energy to cut operating costs and lock in long-term energy savings.

But before installation begins, the key question is — how do we fund it?

This guide outlines the main funding options for commercial solar projects — CapEx, Power Purchase Agreements (PPAs), and Asset Finance — plus a look at available grants and incentives to help businesses make the switch to clean energy.

Can I get funding for solar panels?

In short, yes. Funding for solar panels is real and achievable for both individuals and organisations – whether through government-backed schemes, private finance or tax incentives – there are multiple ways to make the upfront cost of solar more manageable.

Solar funding exists to encourage the adoption of renewable energy, reducing the UK’s reliance on fossil fuels and helping businesses lower their electricity bills. For commercial projects, the financial support available generally depends on the size of your system, energy usage and business type.

Do these funding options apply to businesses?

Absolutely. Solar funding applies across a wide range of sectors, including:

- Manufacturing and industrial sites

- Retail and office space

- Warehouses and logistics centres

- Agricultural and food production

- Charities and non-profits

- Education and public sector organisations

Low Carbon Energy works with businesses of every shape and size to secure the best possible route to funding and offers clear advice and transparent options from start to finish.

Who qualifies for solar panel funding?

Eligibility varies depending on the scheme, but most businesses will qualify if they:

- Are based in the UK and own or lease their premises

- Have a suitable roof or land area for solar panels

- Can demonstrate energy demand during daylight hours

- Are seeking to reduce energy costs or carbon emissions

Some grants also prioritise organisations that can demonstrate they’re actively working towards Net Zero or have measurable sustainability goals in place.

Can schools get funding for solar panels?

Yes, schools can access several funding routes for solar panels, including government-backed loans, local authority sustainability funds and commercial solar finance.

In 2025, the government announced new investment into solar for schools and hospitals, further supporting the transition to renewable energy across the education sector. Schools can also explore options such as asset finance, leasing, or a Power Purchase Agreement (PPA), meaning they can benefit from solar without paying any upfront costs.

For educational institutions, solar can be a practical way to cut electricity bills and demonstrate environmental leadership to pupils and the wider community.

What funding options are available?

1. Capital Expenditure (CapEx) – You own the system

Under a CapEx model, your business purchases and owns the solar system outright. You pay for the design, installation, and commissioning costs upfront, and from the day it goes live you benefit from:

- 100% of the electricity generated

- No third-party energy charges

- Full control over performance, maintenance, and asset value

Financial benefits:

- Typical ROI: 15–25% per annum

- Payback period: 3–6 years, depending on energy prices and site profile

- Once repaid, generation is effectively free power for 20–25 years

Tax advantage – Annual Investment Allowance (AIA):

Solar installations are eligible for the Annual Investment Allowance, meaning you can usually claim 100% of the system cost against taxable profits in year one.

Example:

A company investing £300,000 in solar can deduct the full cost from taxable profit, reducing its corporation tax bill by up to £57,000 (assuming a 19% rate).

This makes CapEx ideal for profitable businesses with available cash reserves looking for the highest long-term return.

2. Power Purchase Agreement (PPA) – Zero Upfront Cost

A Power Purchase Agreement allows your business to benefit from solar without any upfront spend.

Under a PPA:

- A third-party funder or investor pays for the full system, including installation and maintenance.

- Your business buys the energy generated on site at a discounted, fixed rate (typically 20–40% below grid prices).

- You only pay for what you consume, while the investor owns and maintains the system for the contract term.

Advantages:

- No capital outlay or debt impact

- Immediate, guaranteed energy savings

- Fixed energy pricing for 15–25 years

- All operation and maintenance handled by the funder

At the end of the agreement, ownership can often transfer to your business for a nominal sum, providing decades of free, clean electricity.

This is an excellent solution for companies seeking to preserve cash and still advance their Net Zero goals.

3. Asset Finance – Spread the Cost, Stay Cash-Positive

If you prefer ownership but want to avoid the upfront cost, asset finance offers a flexible middle ground.

A finance provider funds the system, and you repay over a 5–10-year term — with the solar array itself acting as security.

Benefits include:

- Immediate ownership from day one

- No large upfront payment

- Predictable monthly costs and energy savings that often exceed repayments

Seasonal payment options:

Many lenders now offer seasonal repayment structures — allowing you to pay more during peak generation months (spring/summer) and less during winter.

This structure mirrors the system’s production profile and helps keep the project cash-positive throughout the year.

Asset finance can also be combined with the Annual Investment Allowance, letting you claim full tax relief even while repaying the system over time.

4. Grants and Incentives

While national grant schemes for solar are limited, there are targeted funding opportunities available through:

- Local councils and regional authorities, who often provide Low Carbon Business Grants or Energy Efficiency Funds.

- Industry-specific programmes, such as those supporting manufacturing, agriculture, or public sector decarbonisation.

Grant values and eligibility criteria vary, but they can contribute significantly toward installation costs or feasibility studies.

To find out what’s currently available, check your local council’s business sustainability or net-zero funding pages, or speak with your solar partner, who can often help identify and apply for relevant schemes.

Comparing the funding options

|

Funding Route |

Upfront Cost |

Ownership |

O&M Responsibility |

Typical Term |

Ideal For |

|

CapEx |

100% upfront |

Business |

Business |

Immediate |

Profitable firms with capital available |

|

PPA |

£0 upfront |

Funder (transfers later) |

Funder |

15–25 years |

Businesses seeking no-cost, risk-free solar |

|

Asset Finance |

None (monthly repayments) |

Business |

Business |

5–10 years |

Firms wanting ownership with steady cash flow |

|

Grant Funding |

Variable |

Business |

Business |

N/A |

Eligible sectors or regions with local incentives |

Which solar funding option is right for you?

Your ideal funding route depends on your organisation’s goals:

- Choose CapEx if you want maximum ROI, tax relief, and full ownership.

- Choose a PPA if you prefer zero upfront cost and no operational responsibility.

- Choose Asset Finance if you want ownership and flexibility while maintaining strong cash flow.

- Explore Grants if your sector or region offers local sustainability funding.

A trusted solar partner can model each option to show projected savings, payback, and environmental impact.

Secure solar funding

At Low Carbon Energy, we help businesses of all sizes navigate the best route to solar adoption — from feasibility and design through to financing and operation.

Our experts can provide a free funding comparison report, illustrating the financial performance and CO₂ savings for each model.

To start exploring your options today, visit our funding page, or contact us to discuss your project with one of our experts.

Energy Technology

Energy Technology

Powering your present. Preserving your future.

Call us on 01282 421 489

strategy be a priority?