Should the government levy a windfall tax on energy firms?

For growing numbers of people, the most obvious solution is a one-off ‘windfall’ tax on major energy companies like BP and Shell, who’ve been posting record profits in 2022. But Chancellor Rishi Sunak is still reluctant – and in recent interviews, he explained why.

What’s going on?

The sheer scale of oil giants’ profits is largely what’s prompted calls for a windfall tax. While the soaring prices for gas and oil have hit most of the UK population hard at the pumps, they’ve also meant massive profits for energy firms so far in 2022. (We should clarify here that this largely applies to energy producers like Shell, rather than energy retailers like British Gas and SSE. A relatively subtle distinction, but an important one!)

Shell and BP in particular have been making record gains – the former made a staggering £7 billion in the first three months of the year, while BP made a decade-high £5 billion. This is despite actively reducing their involvement with Russian oil and gas, following the country’s invasion of Ukraine.

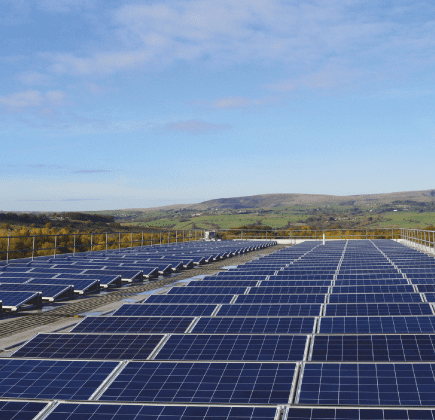

There are a number of reasons for this. First and foremost amongst them; as countries around the world ended their national lockdowns, demand rebounded far more quickly than expected. However, there were lower reserves on hand than there would otherwise be. The same was true for national renewable sources, such as solar and wind, which created more reliance on gas. The lack of supply meant that producers were able to make more money selling oil and gas.

And looking at those figures, it’s probably no surprise that Labour, the Liberal Democrats and the Scottish National Party have all been lobbying the government to impose a windfall tax to pay for tax cuts and benefit boosts for the UK population, who are struggling to cope with the spiralling inflation.

All that is putting rising pressure on the government, especially Rishi Sunak.

What has the chancellor said?

Mr Sunak has said he’s not “naturally attracted” to the idea of a windfall tax, a phrase he took care to emphasise several times in a recent interview with the BBC. Prime Minister Boris Johnson struck much the same tone an interview with LBC, saying that he wasn’t keen on the idea because of its potential to deter future investment in UK energy projects.

In an ideal scenario, they said, they’d prefer for the biggest energy companies to invest in new energy projects in the UK, allowing the British economy and population at large to ultimately benefit from a share of those massive profits.

But if that investment doesn’t materialise, then the government has said that it will take a look at the proposal for a windfall tax. Reportedly, Treasury officials have already been ordered to examine a potential tax, and explore some ways in which it might be implemented.

Now, that doesn’t necessarily mean that it’s happening for certain, but it does mean that energy companies will have to consider their next steps very carefully.

What’s been the reaction?

To be honest? Largely scepticism. In the eyes of many – certainly those on the Labour and Lib Dem benches – it would be a step in the right direction. Crucially though, not many people are convinced that the government are committed enough to the idea.

Critics have pointed out that a windfall tax has been championed by Labour for quite some time now, and the government is only now getting around to properly considering it after intense pressure. That’s signal enough for some people that the chancellor simply doesn’t possess the conviction to follow through on it.

On the other side of the benches, some Conservative backbenchers share the few that it’ll discourage future investment, and that the government should be using the carrot rather than the stick to encourage investment in UK energy projects.

The head of BP, Bernard Looney, has told journalists that his company intended to proceed with all of its UK investments, regardless of whether or not the government decided to impose a windfall tax. Notably, Shell boss Ben van Beurden refused to give a definite answer on whether the company would scale back its investment if it was forced to pay a windfall tax.

But for Frances O’Grady, the TUC general secretary, it wasn’t an either / or situation.

“Multinational companies like Shell and BP have British workers over a barrel,” She said. “Because they control the supply of oil and gas they can set eye-watering prices that are then passed down to households.

‘In the short-term, the government must impose a windfall tax to help pay for support for struggling families. But we also need urgent investment in renewable energy and home insulation so that we are not the mercy of greedy firms, and a shift to public ownership of our energy system.”

So what will the government do?

We realise it’s a bit of an obvious answer, but: we don’t know yet.

It’s worth noting that this wouldn’t be the first government to impose a windfall tax. David Cameron’s government did it, as did Margaret Thatcher’s before him. But as the chancellor’s been at pains to clarify, a windfall tax is not instinctively in his nature. He may also be concerned about the precedent it sets, and the expectations it may create in future. Oil and gas prices are notoriously volatile, and nobody rushed to help oil and gas producers when they lost billions in 2020. The Treasury may be worried that if you tax them when times are sunny, you might have to compensate them when the stormclouds start to gather.

There is also the fact that it’s a very delicate balancing act. The government has publicly outlined its plan for new energy projects to increase energy output from the North Sea, and renewable sources like wind and solar. But it needs energy companies to put in the cash investment, and a windfall tax could make those companies skittish.

Now, massive firms like BP and Shell can take this sort of tax in their stride, but smaller firms may be reluctant to invest in projects on UK shores if they think a tax raid may be likely. They’d probably want firm assurances from the government that it would be a one-off, but even if they get those assurances, there’s no guarantee they’d trust them.

On the other hand, for every day that the decision is delayed, millions of British people are still struggling to pay their bills, with many sliding further into poverty. While the chancellor might be still carefully weighing his options, for others the answer is already clear.

It all serves to highlight that the issue of energy security has never been more important to UK homeowners and businesses alike. Market volatility has long been a staple of the oil and gas industries, and that doesn’t look to change any time soon, especially as prices look set to continually fluctuate due to a variety of factors – including the war in Ukraine, the world’s ongoing economic recovery from Covid-19, and the increasingly urgent transition to a Net Zero economy.

If you’re looking to boost your own energy security though, that’s exactly where we can help here at Low Carbon Energy. Our experts have over 30 years of combined experience, having helped SMEs and large corporations across a wide variety of sectors transform their business’ energy supply.

Each of our installations is bespoke, and we tailor your solution on your specific energy profile, helping us to maximise carbon reductions and save you up to thousands of pounds in energy bills. Feel free to look at our case studies for just a few examples of businesses which have reaped huge rewards from solar, such as Boeing and Irish Water. To find out how we can help you, feel free to give us a call today on 01282 421 489!

Energy Technology

Energy Technology

Powering your present. Preserving your future.

Call us on 01282 421 489

strategy be a priority?